Estimate Your College Costs

Estimate the cost you and your family can expect to pay for Hopkins.

We’re bringing the brightest minds to Hopkins by making a world-class education financially possible. This starts with making financial aid easier to understand and giving you the tools to estimate your college costs and explore payment options that are right for you.

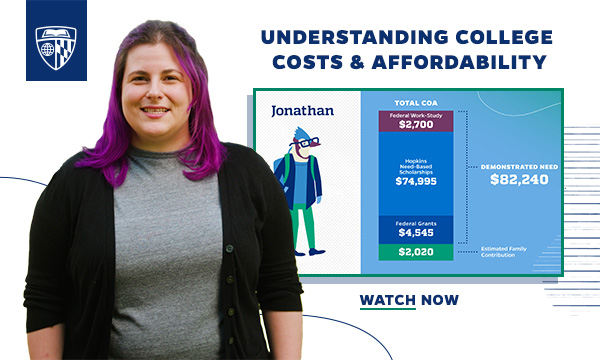

Understanding College Costs & Affordability

Learn how we determine eligibility for financial aid and what goes into our offers.

Play video

Financial Aid Glossary

We clarify commonly used terms you’ll see throughout the financial aid process.

View definitionsCOST OF ATTENDANCE

While the cost of attendance is approximately $91,800 per academic year, many families pay far less, and some pay nothing at all. We’ll work with you and your family to determine an amount that matches your financial circumstances.

Estimation Tools

MYINTUITION QUICK COST ESTIMATOR

Answer six basic questions for a quick, ballpark estimate of your college costs. You’ll need to know your family’s total income, the market value of your home, and your parents’ savings and other assets.

Get Started With MyInTuition

NET PRICE CALCULATOR

This tool uses questions similar to those on the CSS Profile to provide a more detailed estimate of your net price—the amount your family will be responsible for paying. You’ll need tax returns for your parents or legal guardians. Be as specific as you can to ensure the most accurate estimate.

Calculate Your Net PriceHow to compare college costs

Once you’ve used a calculator to estimate your college costs, use this worksheet to compare estimates at your top-choice universities.

flexible options for covering your college costs

Each family’s financial circumstances are unique, and families often use more than one method to cover their costs. If your family would like flexibility beyond the financial aid offer, you can explore the following options:

- Over 60% of our students work part-time, eight to ten hours a week on average. In addition to covering personal expenses, an on- or off-campus job can help you build your resume, make connections, and get involved in the community.

- Regardless of your financial aid eligibility, you can take advantage of our no-interest payment plans that split the cost of your tuition, housing, and meals into equal installments.

- Private scholarships reduce your summer savings and work-study expectations.

- Although our financial aid offers don’t include loans, your family may choose to borrow as part of your financing strategy. We can direct you to low-interest federal loans and Parent PLUS loans.

- You might also consider private loans. We encourage you to look at federal loan options before pursuing these, since their terms and repayment can vary. We have an interactive tool to help you and your family compare private loans.

TALK TO AN ADVISER

Our financial aid advisers are dedicated to helping you and your family understand and evaluate your financial aid options. If you have questions or need assistance throughout the process, you can reach out to us.